What is Retirement Income Planning?

Retirement income planning involves developing a comprehensive strategy to manage your assets and create a steady income stream once you stop working. This plan considers various factors, including your savings, investments, Social Security benefits, pensions, and any other sources of income. Our aim is to help you plan for sufficient income to cover expenses and enjoy your retirement with less financial stress.

What We Do

- Personalized Assessment: We start by understanding your unique financial situation, retirement goals, and risk tolerance. This allows us to create a customized plan that aligns with your needs and aspirations.

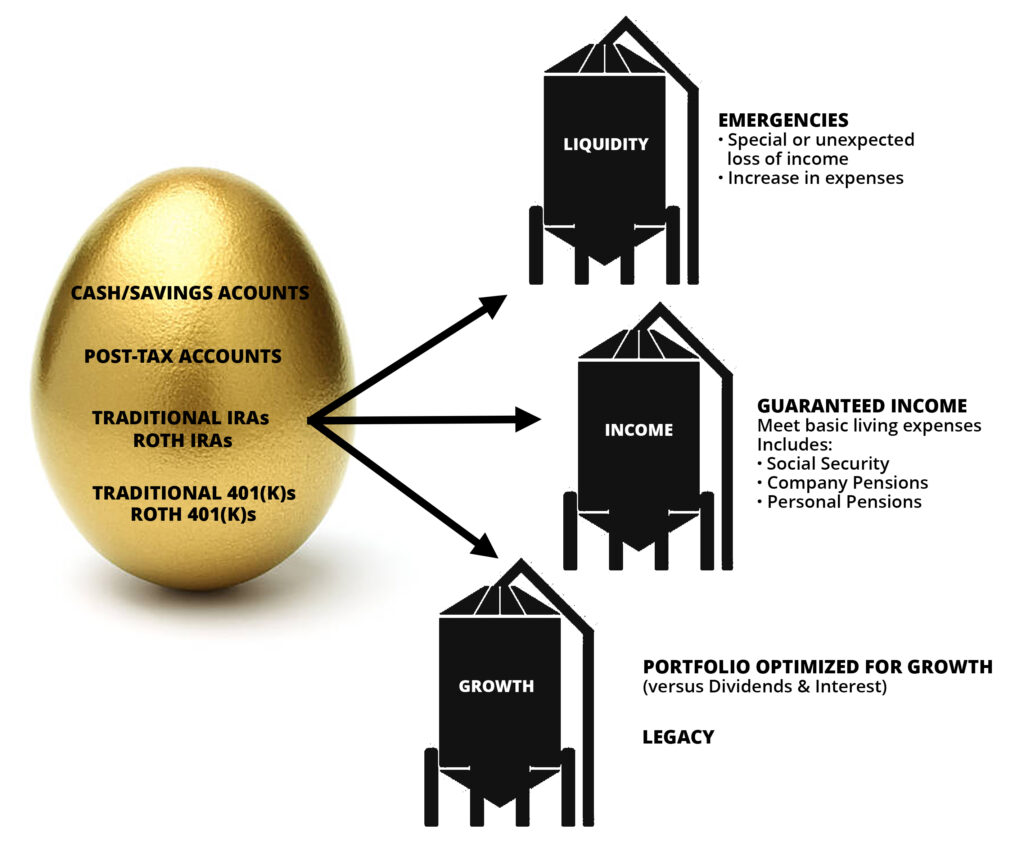

- Income Sources Analysis: We analyze all potential income sources, including savings, investments, Social Security, and pensions. By evaluating these sources, we aim to identify an efficient approach to drawing income.

- Investment Strategy: Based on your risk tolerance and income needs, we develop an investment strategy that seeks to balance growth and security. This approach aims to support asset protection while fostering continued growth.

- Withdrawal Strategy: We aim to create a withdrawal strategy that considers the timing and method for drawing from different accounts, with the objective of maximizing income and potentially minimizing taxes.

- Regular Reviews: Life and market conditions can change, and so can your retirement needs. We regularly review and adjust your plan to keep it aligned with your goals and current circumstances.

At Goal Line Capital, we are committed to helping you achieve a comfortable and worry-free retirement. Our Retirement Income Planning service offers a clear, actionable plan designed to help address your financial stability and well-being in retirement.

Let us help you build a solid foundation for your future. Contact us today to start planning your retirement journey.