Investing wisely involves more than just choosing the right assets; it also requires strategies to manage taxes effectively. At Goal Line Capital, our Tax-Smart Investing service is designed to help you optimize your investment returns by considering the tax implications of your financial decisions. While we do not provide tax advice, we collaborate closely with tax professionals to integrate tax-efficient strategies into your investment plan.

What is Tax-Smart Investing?

How We Help

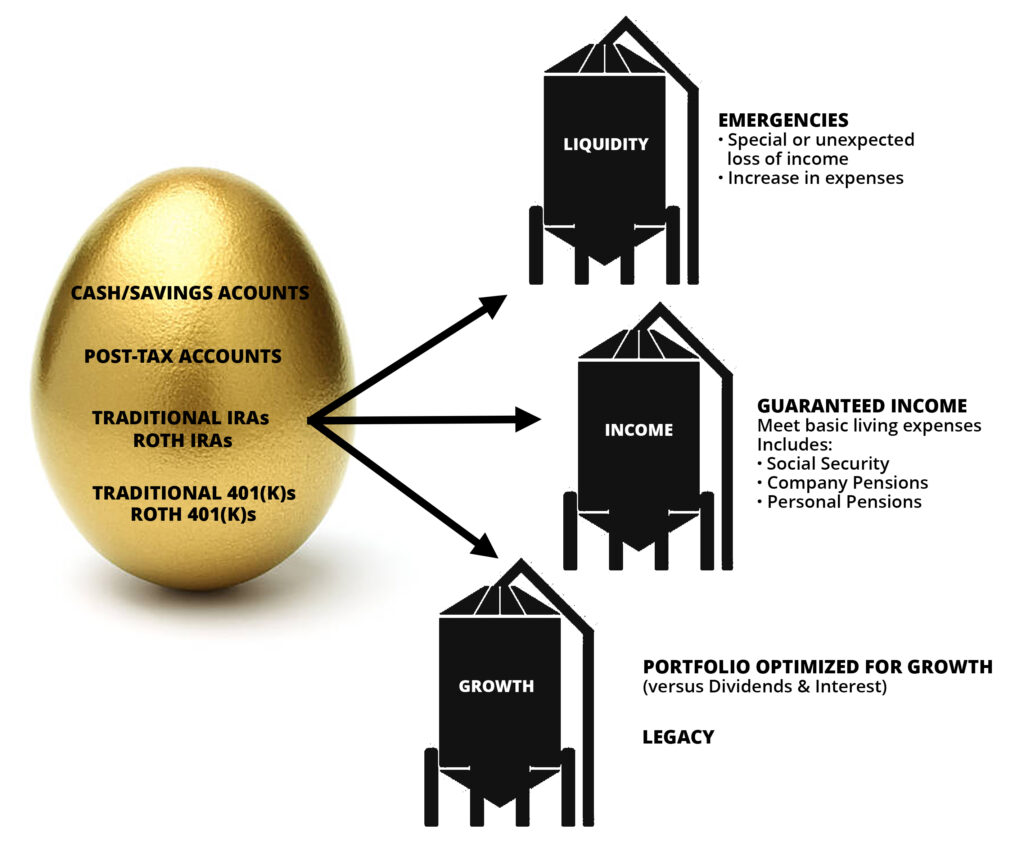

- Asset Location: We carefully select which investments to place in taxable versus tax-advantaged accounts, such as IRAs or 401(k)s. This strategy helps to minimize taxes on investment gains and income.

- Tax-Efficient Funds: We consider using tax-efficient investment vehicles, such as index funds and ETFs, which may generate fewer taxable events compared to actively managed funds.

- Capital Gains Management: We work to manage capital gains by considering the timing of buying and selling investments, helping to reduce the tax impact on your portfolio.

- Tax-Loss Harvesting: We may use tax-loss harvesting techniques, which involve selling losing investments to offset gains, potentially reducing your taxable income.

At Goal Line Capital, our Tax-Smart Investing service is focused on maximizing your investment returns by considering the tax implications of your decisions. By incorporating tax-efficient strategies into your investment plan, we aim to support you in working toward your financial goals effectively.

Contact us today to learn more about how we can help you invest wisely and tax-efficiently.